Home Run Number 46

I'm back celebrating another Home Run, DivGro's 46th! When a stock in my portfolio doubles my original investment in total returns, it becomes a Home Run stock!

After waiting 375 days to celebrate DivGro's 45th Home Run, I'm happy to say the wait for Home Run #46 was just 11 days!

It's fun writing these milestone articles! Doing so reminds me why I became a dividend growth investor!

DivGro's Home Runs

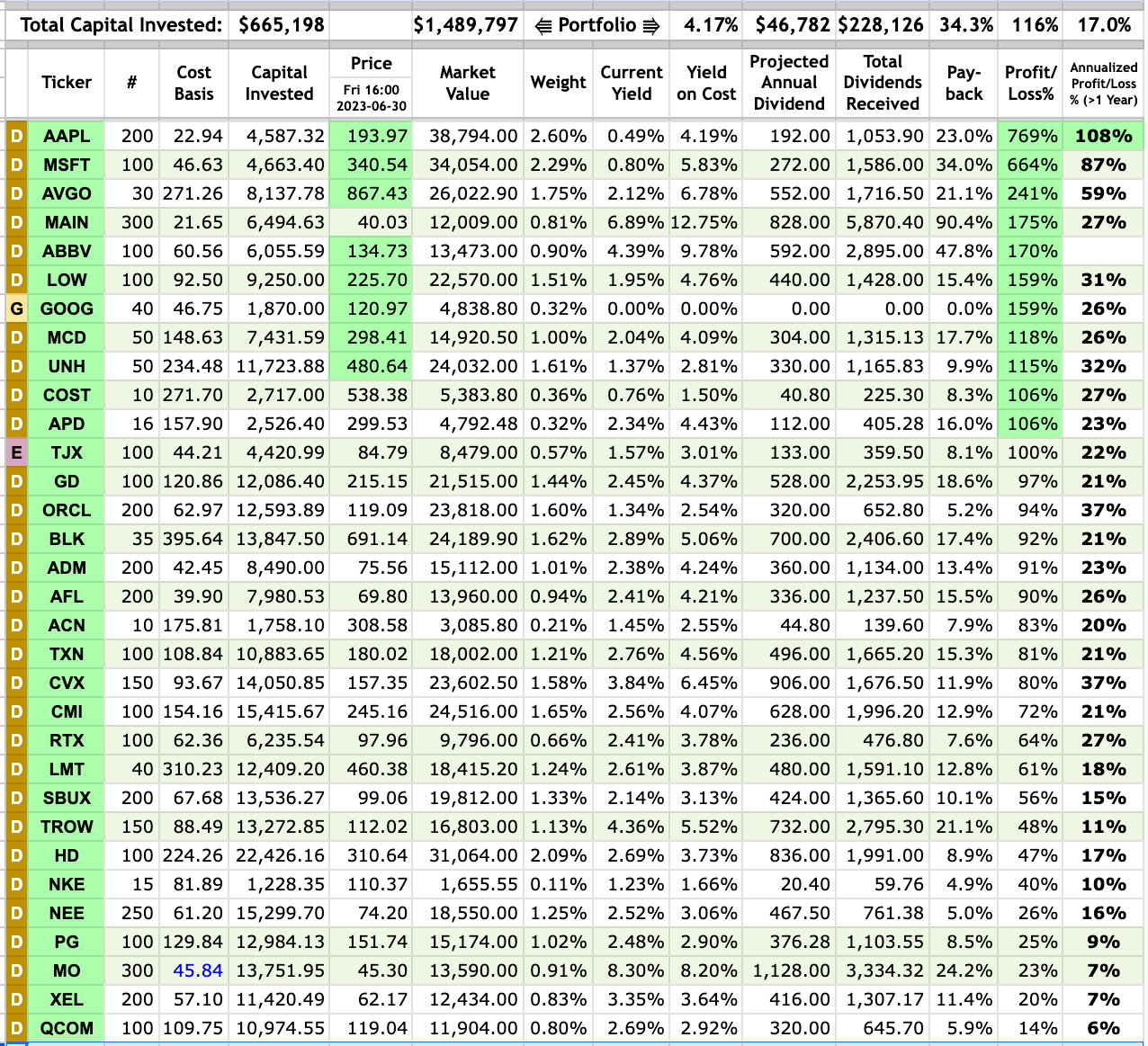

Here are details of DivGro's home runs with updated total returns (and annualized total returns):

| Home Run |

Company (Ticker) | Status | Total Returns |

Annualized Returns |

| #1 | General Dynamics (GD) | Own 100 shares | 97% | 21% |

| #2 | Nippon Telegraph & Telephone (NTT) | CLOSED | 125% | 37% |

| #3 | Digital Realty Trust (DLR) | CLOSED | 102% | 44% |

| #4 | Altria (MO) | own 300 shares | 23% | 7% |

| #5 | Reynolds American (RAI) | CLOSED | 180% | 53% |

| #6 | Main Street Capital (MAIN) | own 300 shares | 175% | 27% |

| #7 | Microsoft (MSFT) | own 100 shares | 664% | 87% |

| #8 | UnitedHealth (UNH) | own 50 shares | 115% | 32% |

| #9 | Northrop Grumman (NOC) | CLOSED | 132% | 46% |

| #10 | McDonald's (MCD) | own 50 shares | 118% | 26% |

| #11 | AbbVie (ABBV) | own 100 shares | 170% | 26% |

| #12 | Lockheed Martin (LMT) | own 40 shares | 61% | 18% |

| #13 | Raytheon Technologies (RTX) | own 100 shares | 64% | 27% |

| #14 | Netflix (NFLX) | CLOSED | 90% | 16% |

| #15 | INTEL (INTC) | CLOSED | 16% | 6% |

| #16 | Valero Energy (VLO) | CLOSED | 90% | 23% |

| #17 | Aflac (AFL) | own 200 shares | 90% | 26% |

| #18 | Apple (AAPL) | own 200 shares | 769% | 108% |

| #19 | Xcel Energy (XEL) | own 200 shares | 20% | 7% |

| #20 | Amazon.com (AMZN) | CLOSED | 71% | 13% |

| #21 | Salesforce.com (CRM) | CLOSED | 16% | 5% |

| #22 | Procter & Gamble (PG) | own 100 shares | 25% | 9% |

| #23 | Taiwan Semiconductor Manufacturing (TSM) | CLOSED | 47% | 40% |

| #24 | Pinterest (PINS) | CLOSED | 161% | 176% |

| #25 | Air Products and Chemicals (APD) | own 16 shares | 106% | 23% |

| #26 | QUALCOMM (QCOM) | own 100 shares | 14% | 6% |

| #27 | Cummins (CMI) | own 100 shares | 72% | 21% |

| #28 | NextEra Energy (NEE) | own 250 shares | 26% | 16% |

| #29 | BlackRock (BLK) | own 35 shares | 92% | 21% |

| #30 | T. Rowe Price (TROW) | own 150 shares | 48% | 11% |

| #31 | Texas Instruments (TXN) | own 100 shares | 81% | 21% |

| #32 | Alphabet (GOOG) | own 40 shares | 159% | 26% |

| #33 | Disney (DIS) | CLOSED | 88% | 15% |

| #34 | Lowe's (LOW) | own 100 shares | 159% | 31% |

| #35 | FedEx (FDX) | CLOSED | 46% | 14% |

| #36 | NIKE (NKE) | own 15 shares | 40% | 10% |

| #37 | Starbucks (SBUX) | own 200 shares | 56% | 15% |

| #38 | Accenture plc (ACN) | own 10 shares | 83% | 20% |

| #39 | Broadcom (AVGO) | own 30 shares | 241% | 59% |

| #40 | Home Depot (HD) | own 100 shares | 47% | 17% |

| #41 | Costco Wholesale (COST) | own 10 shares | 106% | 27% |

| #42 | CVS Health (CVS) | CLOSED | 49% | 12% |

| #43 | Archer-Daniels-Midland (ADM) | own 200 shares | 91% | 23% |

| #44 | Chevron (CVX) | own 150 shares | 80% | 37% |

| #45 | Oracle (ORCL) | own 200 shares | 94% | 37% |

Several stocks in the list above show total returns of less than 100%.

My policy is that once a stock becomes a Home Run stock, it retains that status even if the total returns should dip below 100%. That can happen if the share price drops or if I buy additional shares at a higher cost basis.

Note that I've reopened positions in DLR and NOC after closing my original positions, both home runs. Repeat positions like DLR and NOC will have to earn home run status all over again... they don't get a free ride!

Below is a snapshot of DivGro's existing home run stocks, sorted by total profit/loss%:

Thirty-two of my existing positions are Home Run stocks. With annualized total returns of 108% and 87%, respectively, AAPL and MST remain my most successful investments!

Home Run #46

DivGro's 46th home run stock is TJX (TJX).

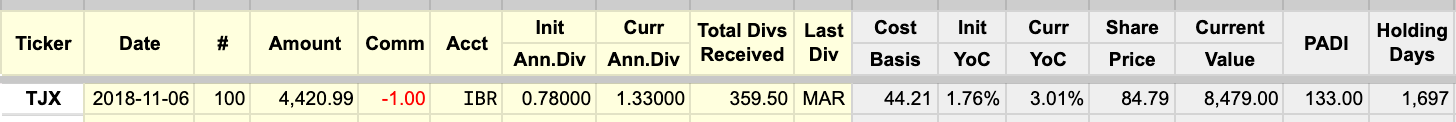

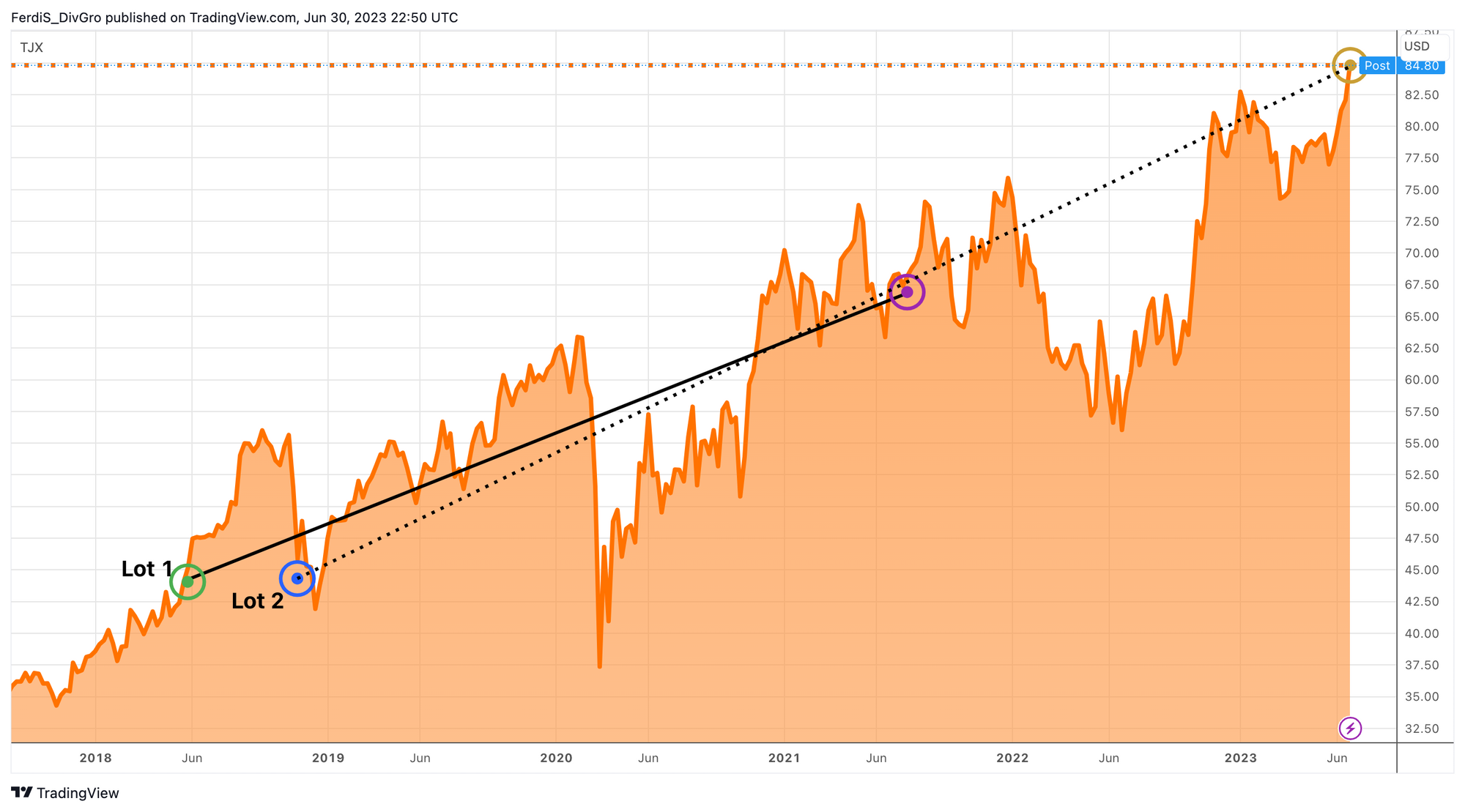

I first opened a position in TJX in May 2018, buying 100 shares at a cost basis of $44.21. In November, I doubled my original position, also at a cost basis of $44.21. In July 2021, I closed the first lot for a gain of 57.2% (or 17.7% annualized). Here are details of the second lot:

TJX took 1,697 days to become a Home Run stock.

Below is a price chart of TJX indicating my trades and the point where the stock reached home run status:

TJX recovered nicely over the past year, increasing from $54.92 on 30 June 2022 to $84.79 on 30 June 2023, or 54% in twelve months.

My TJX position has delivered total returns of 100% (or 22% annualized), which include dividend income of $359.50.

A Home Run Contender

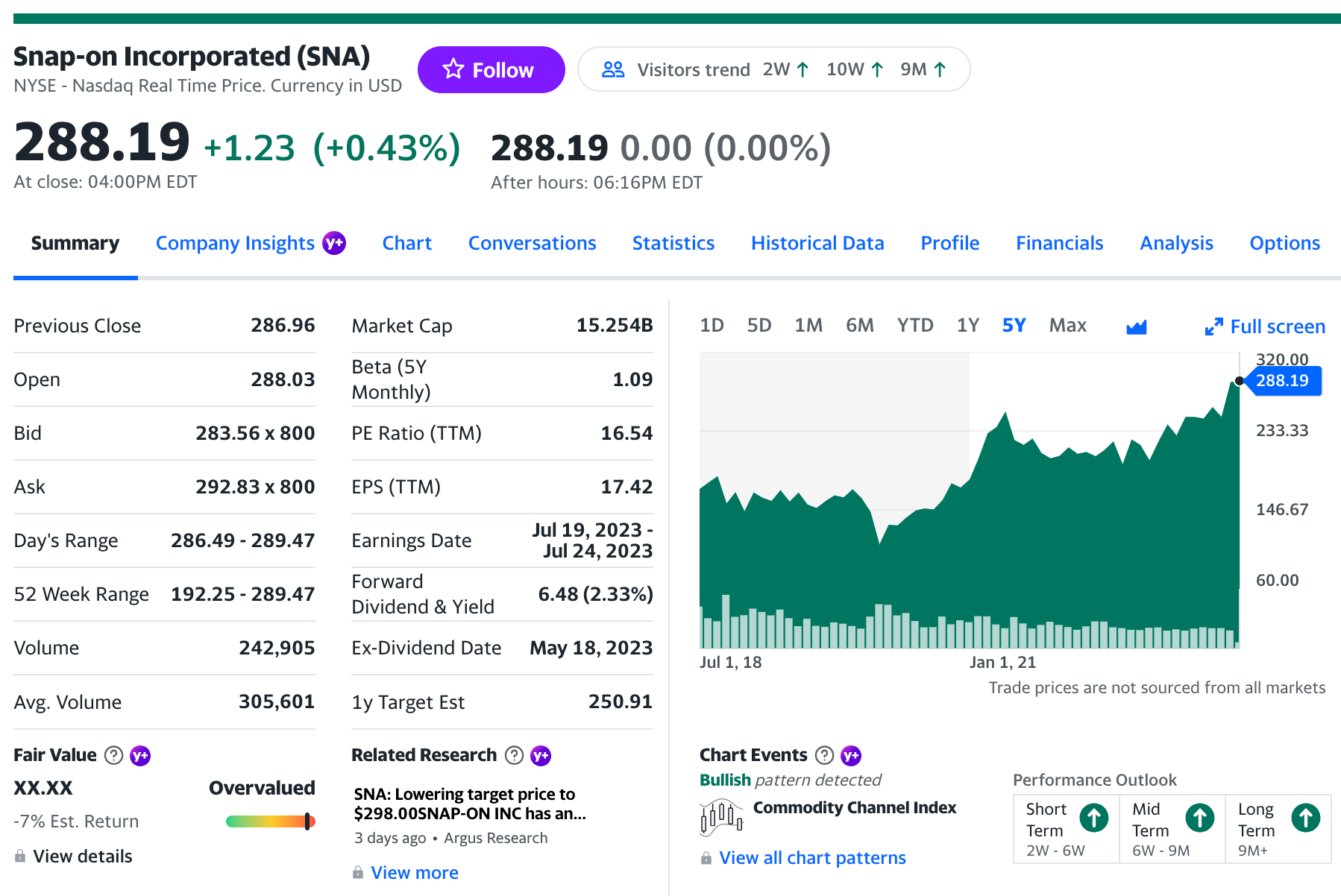

Here is the nearest Home Run contender based on total annualized returns:

- Snap-on (SNA) — up 97% (27% annualized)

Concluding Remarks

With total returns exceeding my initial investment, TJX is the latest Home Run stock in my DivGro portfolio. I'm curious to see when SNA becomes a Home Run stock!

Thanks for reading, and happy investing!

You're welcome to follow me on Twitter and Facebook.